Prepared by Paul A Scuffham, PhD, FAHMS, Chair of ISPOR Asia Consortium Executive Committee and Director of Menzies Health Institute Queensland, Griffith University, Gold Coast, Australia

ISPOR Asia Consortium has been busy this year, with a range of events including Executive Committee meeting in February, the webinar “Value-based Payment in Asia Pacific: Case Studies and Lessons Learned” held in April, an Industry Committee meeting in June, the Asia Pacific Health Policy Update meeting in July (the subject of this report), the two-day Virtual ISPOR Asia Pacific Summit 2022 in September, followed by the Asia Pacific HTA and the Patient Representative Roundtables at the end of September.

The ISPOR Asia Consortium hosted a virtual open meeting focusing the Asia Pacific regional health policy developments on 13 July 2022. Over 100 participants attended. The Executive Director and CEO of ISPOR, Nancy Berg, gave a welcome speech and the ISPOR Global Networks Director, Robert Selby, provided a brief report on the Asia Consortium’s main activities in 2022. Expert speakers from China (Distinguished Professor Gordon Liu), the Philippines (Pura Angela Co) and Singapore (Benjamin Ong) were invited to present at this meeting. This is a summary report of that very informative meeting.

China’s Policy Updates for the National Reimbursement Drug List (NRDL)

Gordon G. Liu, PhD, Peking University BOYA Distinguished Professor of National School of Development, and Dean of the Institute for Global Health and Development, Beijing, China

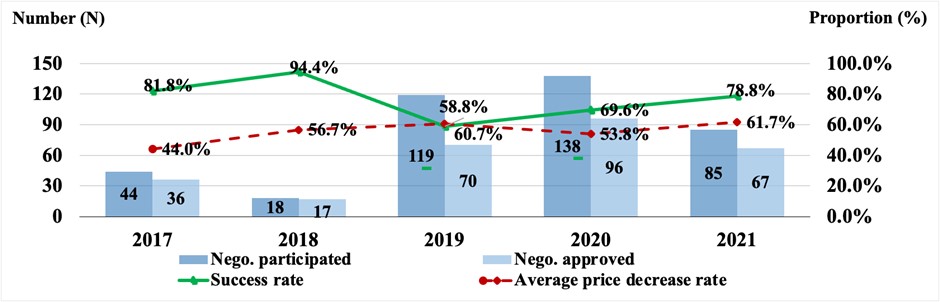

The State Drug Price Negotiations

Starting in 2018, the Chinese National Healthcare Security Administration conducts annual state drug price negotiations with manufacturers. Reducing the price of drugs through this negotiation process has been highly successful (see the graph below). The highest reduction in pricing was from a special negotiation on anticancer drugs in 2018. Over time there has been an upward trend in the success of price negotiations, partly because the national medical insurance negotiation became normalized since 2020 with more transparent and clearer procedures for firms to follow and prepare for submission and negotiation. The average price reductions for the negotiated drugs in 2020 and 2021 were 53.8% and 61.7%, respectively.

Note: The 2017 national negotiation was conducted by the Chinese Ministry of Human Resources and Social Security (MOHRSS). Since 2018, the national negotiations were conducted by Chinese National Healthcare Security Administration (NHSA).

Source: MOHRSS and NHSA. http://www.gov.cn/xinwen/2017-07/19/content_5211741.htm#1; http://www.nhsa.gov.cn/art/2018/10/10/art_37_1057.html; http://www.nhsa.gov.cn/art/2019/11/28/art_53_2057.html; http://www.nhsa.gov.cn/art/2020/12/28/art_53_4224.html; http://www.nhsa.gov.cn/art/2021/12/3/art_105_7439.html.

The 2022 NRDL State Negotiation Workflow

In 2022, the state negotiation workflow for the national reimbursement drug list (NRDL) is expected to follow 5 steps (preparation, application, review, negotiation, and formation) over approximately 6 months starting in May/June.

Initially a panel of comprehensive experts assess clinical value based on five dimensions: effectiveness, safety, economy, innovation, and fairness. After this round of review, a list of recommendations would be formulated, containing further reviews and negotiation, renewal, and direct listing. Based on the recommendations by the first panel, two review panels follow: one is a pharmacoeconomic expert panel and an insurance expert panel. The former is focused on the work of cost effectiveness evidence, and the latter is on budgetary assessment for submitted products. The final step is conducted by a negotiation panel directly with manufacturers based on the recommendations consolidated from the three expert panels.

NRDL Review Principles in 2022

- Since 2020, manufacturers can self-select reference drugs when preparing their submissions. Some selection principles for reference medicines includes same indication, same class in the current NRDLs, recommended in the clinical guidelines, used in the RCTs, etc.

- The ICER threshold recommended in the 2020 China PE Guidelines is 1-3 times GDP per capita. The actual threshold employed in the 2021 state negotiations was 0.5-1.5 times GDP per capita. However, a larger threshold was applied to more innovative drugs for rare diseases and some cancer drugs with higher clinical value scores given by the clinical expert panel.

- The drugs with multiple indications are uniformly priced in the 2022 NRDL. In the 2022 work plan, new indications can be handled according to the renewal rules. For different specifications/doses of a drug, a rule of “differential ratio pricing” is followed using the most widely used specification as the benchmark.

- There is a simplified renewal approach (price adjustment rules) for contracted drugs without adding new indications. The method of price adjustment is based on a ratio of the actual expenditure of a contracted drug to the estimated budget, known as “A Ratio”. If the A Ratio of a drug is less than 10%, there will be no change in pricing to renew the contract. If the A ratio is greater than 10%, the new contract price will be cut following a price cut schedule jointly determined by both the drug market scale and the A Ratio value - ranging from 5% to 25%. For an A Ratio greater than 200%, a drug product cannot go through the simple renewal approach, instead it must be re-negotiated for a new price.

- A simplified renewal process can also be applied to drugs with new indications: First, a benchmark price is set according to the price adjustment based on the “A Ratio” without consideration of the new indication. Second, a “B ratio”, determined by the ratio of the incremental revenues of the new indication compared to the estimated revenues without the new indication. For a B Ratio greater than 10%, the new contract price starts following a downward schedule of 5%-25%, depending on both the product market scale and the value of the B ratio. If B Ratio is greater than 100%, re-negotiation is required.

- For available generic drugs, a 3-stage bidding approach is used for price adjustments:

- NHSA propose the willingness to pay: An insurance expert panel proposes a recommended price as the benchmark indicating the insurer's willingness to pay

- Manufacturers submit bidding prices: The bidding prices are compared with the benchmark price; if the bidding price is not higher than the benchmark price, the bidding drugs can be included in the B list.

- To determine the final price: The lowest bidding price will be the payment standard, subject to a price floor at 70% of the benchmark to prevent destructive competition.

The Philippines Healthcare Reforms: The Universal Healthcare Act and its Implications for HTA

Pura Angela Wee-Co, MD, MSc, MAHPS, Country Director, Philippines at ThinkWell, Manila, Philippines

The Philippine Universal Healthcare (UHC) Act, enacted in 2019, has started to reshape how healthcare is financed and delivered in the Philippines. The Act mandates that “Every Filipino shall be granted immediate eligibility and access to preventive, promotive, curative, rehabilitative, and palliative care for medical, dental, mental and emergency health services, delivered either as population-based or individual-based health services.” However, the health services provided “must be determined through a fair and transparent health technology assessment process.” This has major implications for the role of HTA in the Philippines.

Many of the mandates of the Act are on health financing, including clearly delineating PhilHealth as the strategic purchaser of individual-based health services from public and private Health Care Provider Networks. More funds will eventually be generated for PhilHealth through increased premium rates and pooling of resources at the national level. Local Government Units (LGUs) will also be incentivized to reintegrate back to provincial systems, develop networks and pool funds through a Special Health Fund. The UHC Act also states that HTA shall be institutionalized as “a fair and transparent priority setting mechanism for the development of policies and programs, regulation, and the determination of a range of entitlements.” Since then, the Department of Health (DoH) has released an additional policy which defines the overall institutionalization and implementation framework for HTA through the “Process and Methods Guides” as a priority setting for universal health cover.

The HTA process guide describes the structure for stakeholders and additionally clarifies the scope of HTA including what technologies and which stakeholders are affected. It also defines the governance structure of HTA in the DoH. Through the UHC Act, the HTA Council was created whose core committee facilitates the provision of financing and coverage recommendations on health technologies to be financed by the DoH and PhilHealth. The HTA Council are supported by the HTA Unit within the DoH which acts as their secretariat. The DoH has also allocated funds for a HTA Research Network to further involve academic bodies in the country in terms of generating HTA information.

The process guide describes the process for Topic Nomination, Topic Prioritization, Scoping Protocol and Development, Topic Assessment, Evidence Appraisal, Initial Recommendation, Resolution, Decision and Dissemination. A faster expedited HTA process was also defined for public health emergencies but even with an expedited timeline, HTA approval can take as much as 24 weeks. With the pressure of the COVID pandemic, this HTA process was reduced to around 3 months. The experience of HTA during the pandemic also created additional processes such as an “Urgent HTA” process for urgent but non-public health emergency concerns as well as those needing minor applications. Clarity around stakeholder participation, roles and responsibilities was also addressed during the pandemic with a more inclusive process.

The DOH also released an HTA methods guide to provide guidance to all those involved in conducting health technology assessment (HTA). The Basic Methodological Framework of HTA in the Philippines illustrates that research questions need to be clearly articulated in Population-Intervention-Comparator-Outcome-Timeframe (PICOT) format. The initial research phase is for clinical assessment defined in a study protocol stating the research questions, objectives, and methods. The second stage of the assessment is the economic evaluation. Economic evaluations shall include both a CEA or a CMA and a budget impact analysis (BIA) to assess both the value for money of a health technology and its affordability or the feasibility of publicly funding the health technology relative to the Philippine context. All HTA Reports must include the analysis of ethical, legal, social, organizational and health system implications for the Philippines.

In conclusion, there have been significant progress in terms of the institutionalization of HTA in the country with the mandates of the UHC Law. Overall, government institutions have been created, processes have been clarified and additional resources have been put into the conduct of HTA inside and outside of the DoH. However, there are still gaps in ensuring that the HTA process leads to an overall prioritization of health services and interventions that must be covered through various funding sources and strengthened in terms of implementation. Delays in assessment brought about by lack of resources also continues to be a significant challenge and policy makers must also address insufficient translation of HTA to its desired outcomes considering that out-of-pocket expenses are the largest source of funding for health services. There is a continued push from various stakeholders to ensure UHC across the country and various resources to ensure awareness and capacity to undertake HTA such as what as ISPOR is providing. With this, ISPOR Philippines will continue to provide support to strengthen HTA in the country.

Singapore: Updates on health system reforms and HTA developments

Benjamin Ong, Senior Lead Specialist, Agency for Care Effectiveness, Ministry of Health, Singapore

Health system reforms

Driven by an aging population, increasing burden of chronic diseases, and rapid medical technology advancements, Singapore’s healthcare expenditure has grown rapidly and more than doubled over the past decade.

In 2016, the health ministry articulated three fundamental long-term transformational shifts (or “Beyonds”) to Singapore’s healthcare system.

(i) “Beyond health care to health” focused transformation efforts on effective health promotion and disease prevention through screening, immunization, and education.

(ii) “Beyond hospital to community” aimed at successful ageing and enabling Singaporeans to receive care in the community through strengthening the primary care sector and enhancing public-private partnerships.

(iii) “Beyond quality to value” aimed to give Singaporean the best healthcare value, while keeping the system sustainable.

The health ministry announced in March 2022 that a “Healthier SG” strategy will be developed to further enhance efforts upstream on keeping individuals healthy, driving preventive health and early intervention. The goal is to achieve a coordinated, seamless and integrated care system where individuals will be supported by a care team comprising primary care providers, community partners, and regional healthcare clusters throughout their life course. Key elements include (i) mobilizing the network of family physicians, (ii) develop primary care plans to encourage citizen participation and adherence, (iii) community partnerships and integrated ecosystem to support better health, (iv) national primary care enrolment program, and (v) support structures e.g. manpower, IT and data, and financing reviews.

Managing cost and affordable access to health technologies

Spending and insurance payouts for cancer drug treatments have increased significantly over recent years. Currently, under the universal insurance MediShield Life, up to $3,000 per month can be claimed for cancer treatments. This claim limit does not incentivize drug manufacturers to offer better prices, nor does it encourage the use of cost-effective treatments. Effective 1 September 2022, the claim limits will be revised to be more granular and in line with agreed cost-effective prices for cancer drug treatments on a positive list of clinically- and cost-effective drugs. With an average 30% price reduction achieved through value-based pricing negotiations, more cancer drugs will also be subsidised.

Similarly, a positive list of medical implants will be established based on HTA principles, value-based pricing and extensive clinician consultations. The aim of the revised framework is to provide targeted subsidy for patients and to encourage the use of clinically- and cost-effective medical implants.

ACE was established in 2015 as the national HTA agency to drive appropriate care, improve patient outcomes and optimize healthcare value. Recent developments include:

(i) A company-led submission process was initiated in 2021 for new cancer treatments and indications. This process aimed to bring funding decisions upstream, close to the point of market entry, to minimise delays to treatment access.

(ii) In January 2022, ACE embarked on risk sharing arrangements (RSAs), mainly price-volume arrangements (PVAs), to help better manage budgetary uncertainties associated with high cost treatments such as cancer drugs.

(iii) A Consumer Engagement and Education workstream was established to help patients, carers and the public become involved in ACE’s work, and to empower them to make informed decisions about appropriate treatment choices.

###

Let’s keep this going! Together, we can further accelerate our impact and the impact of HEOR by:

- Engaging the diverse community of healthcare stakeholders

- Informing issues through the use of HEOR and data approaches

- Applying HEOR to address current challenges