Centers for Medicare & Medicaid Services CMS →

CMS represents the public health insurance provider for around 30% of Americans and

combines the oversight of the Medicare program, the federal portion of the Medicaid program

and the Children’s Health Insurance Program (CHIP), the Health Insurance Marketplace,

and related quality assurance activities.

Medicare is a single-payer national health insurance program that began in 1966. Funding

for this program comes from payroll taxes, premiums and surtaxes from beneficiaries, and

general federal revenue. It primarily provides health insurance to Americans aged 65 and older

who have paid into the Social Security system through payroll taxes (for more information, see

The Facts on Medicare Spending and Financing under Suggested Reading). Additional health

insurance coverage through Medicare is provided to younger people with some disability,

patients with amyotrophic lateral sclerosis, or patients with renal failure requiring dialysis

or transplant. Coverage for Medicare is broken down into 4 parts, A through D. Traditional

Medicare plans (A, B, and D) do not contain an out-of-pocket spending limit.

Medicare Part A coverage relates to inpatient hospital costs, skilled nursing,

and hospice services.

Medicare Part B coverage relates to outpatient physician services. Durable medical equipment

(DME), such as diabetic testing supplies, is covered under these plans. Some drugs also may be

covered under Medicare Part B and are usually treatments that require the intervention of a

physician to administer, such as chemotherapy, immunosuppressant drugs, and dialysis drugs.

Also known as a Medicare Advantage (MA) Plan, Medicare Supplement Plans, or Medigap,

Part C coverage is an alternative to traditional Medicare that allows patients to choose private

plans with at least the same benefits of Parts A and B, and often D (as a Medicare Advantage

Prescription Drug [MAPD] plan). These plans provide an annual out-of-pocket spending limit,

which traditional Parts A and B plans do not contain.

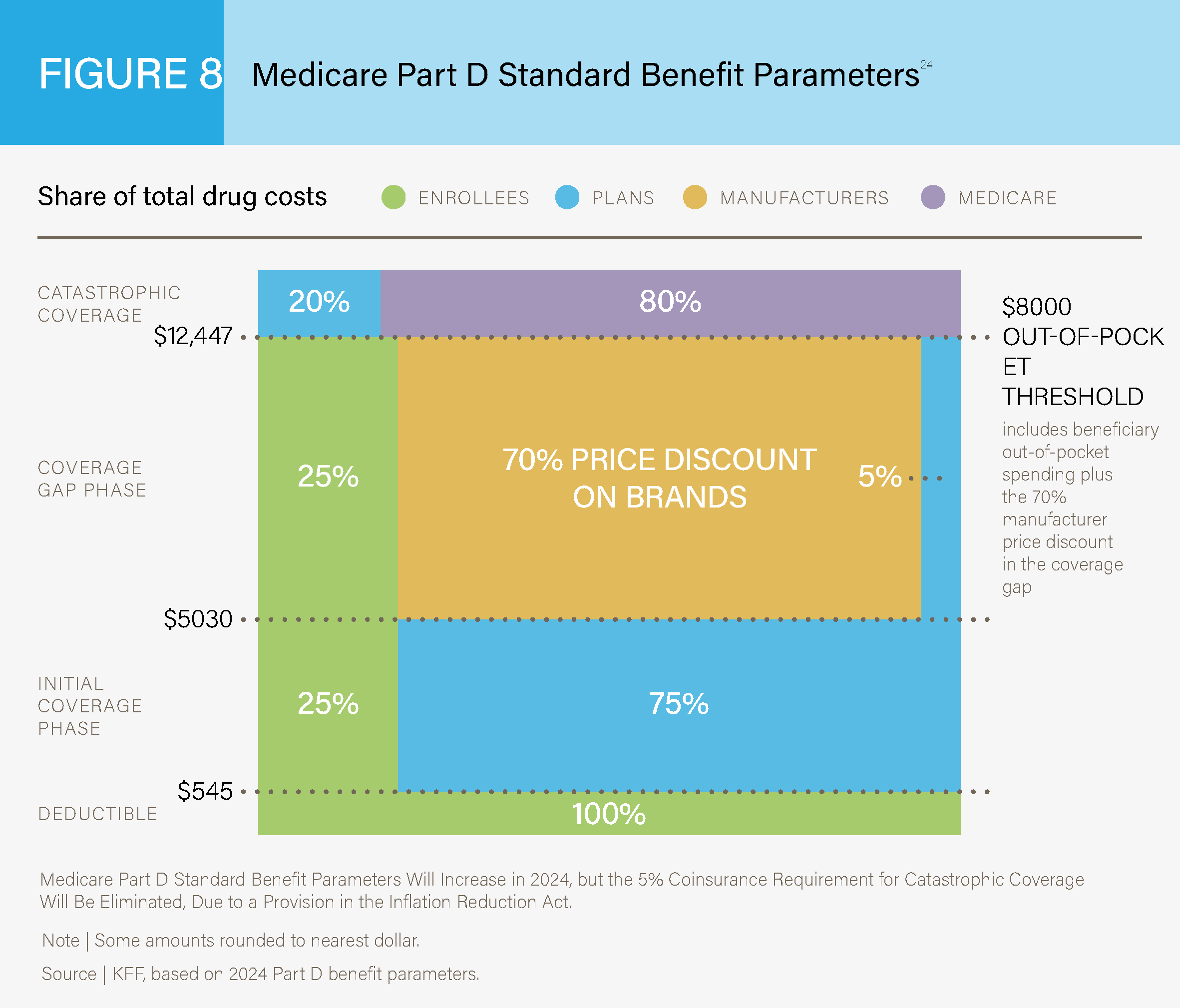

Medicare Part D coverage relates to prescription drug coverage. This coverage has a standard

benefit design for all patients. See Figure 8 below for a breakdown of costs for Medicare Part D

plans in 2019.24

Medicare Part D Standard Benefit Parameters24

Medicaid is a joint federal and state program that provides healthcare coverage for patients

with limited income and resources. It is the largest source of funding for medical and health-

related services for people with low income in the United States. It is jointly funded by the

state and federal governments and managed by individual states, who determine eligibility.

Recipients must be US citizens or legal permanent residents and may include low-income

adults, their children, and people with certain disabilities. Poverty alone does not necessarily

qualify a person for Medicaid.

State Children’s Health Insurance Program (CHIP)

CHIP provides low-cost health coverage to children in families that earn too much to qualify for

Medicaid. In some states, CHIP covers pregnant women as well. It is a jointly federal- and state-

funded program where individual states determine exact coverage rules; however, all states

are required to provide basic comprehensive coverage including prescriptions and doctor visits.

Routine visits are free under CHIP but there may be copayments for other services. Some states

charge monthly premiums for CHIP coverage, but those will not be more than 5% of the family’s

annual income.25

Veterans Health Administration (VHA)

The VHA is a federal healthcare entity funded by the Department of Veterans Affairs (VA). More

than 1300 hospitals, outpatient clinics, counseling centers, and long-term care facilities provide

care to active and discharged individuals from the armed forces. Although many individuals are

eligible, demand exceeds capacity, so a priority system has been developed to provide care to

those most in need. The VA health system is owned and operated by the federal government.26

Military Health Systems (MHS)

The MHS is a federal healthcare entity funded by the Department of Defense. This integrated

healthcare system provides medical care in combat situations, overseas bases, and in the

United States to active military and dependents. MHS, unlike the VA, is not a completely

federally funded system and relies on a government insurance plan, TRICARE, which is

managed by the Defense Health Agency.27

Managed Care Organizations (MCOs)

MCOs operationalize health insurance for their enrollees by providing a complete healthcare

delivery system consisting of affiliated and/or owned hospitals, physicians, and other providers

that provide a wide range of coordinated health services. These health organizations contract

with insurers, or self-insured employers, to deliver healthcare.

Health Maintenance Organizations (HMOs)

In this healthcare plan model, patients tend to have lower monthly premiums and “in-network”

restrictions on primary care physicians. Sometimes, patients are required to select a single

primary care physician for treatment. Specialists require referrals from the primary care

provider, and out-of-network services are not covered. Premiums and deductibles are often

lower when compared to preferred provider organizations.

Preferred Provider Organizations (PPO)

These health plans have a preferred network of providers but will still cover out-of-network

care. Patients can see specialists without a referral from a primary care physician visit. Because

these plans are less restrictive, patients tend to have higher monthly premiums and cost-

sharing. These plans have lost some popularity due to efforts to control costs. Premiums and

deductibles are often higher when compared to HMOs.

Tiered-Network Plans (TNP)

Tiered networks can be considered a hybrid plan that combines the physician networks of an

HMO and the expanded network options of a PPO. With a tiered network, members pay lower

out-of-pocket costs when they visit a preferred tier provider. Patients can visit nonpreferred

physicians for healthcare but will pay more out of pocket. Even if a patient visits a nonpreferred

physician, the incurred out-of-pocket costs go towards the out-of-pocket limits established by

the Affordable Care Act (ACA).

Integrated Delivery Networks (IDN)

IDNs utilize vertical integration of healthcare to deliver the full range of healthcare services to its

patients. The major distinction of an IDN is that the healthcare providers covered by the health

plan are also employees of the health plan, rather than contracted physician networks. When

patients receive care in the outpatient, specialist, and inpatient settings, they will utilize services

owned and provided by the health plan executor. Kaiser Permanente, on the West Coast of the

United States, is a good example of this type of healthcare delivery system.28

Pharmacy Benefit Managers (PBM)

PBMs design, implement, and manage pharmacy benefits and coverage. Health plans

and self-insured employers often partner up with PBMs and let the latter manage

pharmacy-related insurance responsibilities.

In addition to the private health plan organizations listed above, many employers will choose to

self-insure and fund their own healthcare plans for their employees. In this scenario, employers

will contract with healthcare providers to administer their health plans but have full control

of coverage options and total responsibility for costs. These self-insured employers are able

to offer health plans tailored to their insured population and can serve as a cost-containment

method. There is the risk, however, of high-cost individuals driving up overall costs to the

employer, who maintains full responsibility for payment.